K

Kathleen Martin

Guest

Wouldn’t it be nice, if, instead of relying on adjusters and restoration companies to surmise how much damage was actually caused by a water leak, an insurer could stop the leak almost before it starts.

That’s now the reality for a growing number of insurers who have deployed leak sensors at commercial, institutional and residential properties. These Internet of Things devices are well on their way to becoming standard features of insurance policies

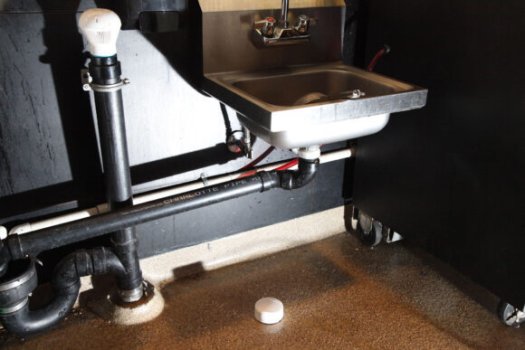

Chubb, known as the world’s largest publicly traded property insurance company, has embraced the technology wholeheartedly and is pushing ahead with thousands of the hockey-puck-sized sensors around the country. More than 300 Chubb-insured buildings now have the systems in place. It’s all part of Chubb’s declared “war on water damage,” which notes that non-weather-related water damage is one of the biggest drivers of losses for the insurance industry.

Two years into its sensor strategy, the company has compiled a number of examples of how the wireless devices have saved the day and prevented millions of dollars in property losses. In a recent interview with the Insurance Journal, Chubb and an official at Providence College in Rhode Island explained how the devices have worked out.

Continue reading: https://www.claimsjournal.com/news/national/2022/02/08/308536.htm

That’s now the reality for a growing number of insurers who have deployed leak sensors at commercial, institutional and residential properties. These Internet of Things devices are well on their way to becoming standard features of insurance policies

Chubb, known as the world’s largest publicly traded property insurance company, has embraced the technology wholeheartedly and is pushing ahead with thousands of the hockey-puck-sized sensors around the country. More than 300 Chubb-insured buildings now have the systems in place. It’s all part of Chubb’s declared “war on water damage,” which notes that non-weather-related water damage is one of the biggest drivers of losses for the insurance industry.

Two years into its sensor strategy, the company has compiled a number of examples of how the wireless devices have saved the day and prevented millions of dollars in property losses. In a recent interview with the Insurance Journal, Chubb and an official at Providence College in Rhode Island explained how the devices have worked out.

Continue reading: https://www.claimsjournal.com/news/national/2022/02/08/308536.htm